For years, economic developers could boast about the region’s lower-cost climate. But with the region still lagging in wage growth, it’s time for employers to pay up.

As recent trips to Publix will attest, these times aren’t cheap.

From grocery bills to expensive takeout to skyrocketing rents, anecdotal evidence of inflation is all around us.

But trying to nail down the best metric to gauge the “affordability” of our region compared to others is not as easy as calling up the Cost of Living Index. Economic developers often cite the index when looking to compare metros to attract companies and talent.

There’s a lot riding on understanding affordability, especially for regions in hypergrowth like Tampa Bay. It is a factor that will distinguish winners and losers in a national battle for residents, headquarter relocations, talent and investment. It drives policy and resource decisions.

A deeper look into how affordability is analyzed shows the Cost of Living Index is a small piece of the puzzle.

The company responsible for the COLI is Arlington, Virginia-based C2ER, an organization representing community research professionals.

The U.S. Census Bureau and the U.S. Bureau of Labor Statistics recognize its quarterly index, published since 1968. C2ER employs more than 300 researchers to analyze 60 goods and services in six categories: food, housing, utilities, transportation, health care, and miscellaneous goods and services, as well as a composite index. It caters to job seekers, human resource managers, academic and market researchers, chambers of commerce, site selectors, economic development organizations and Realtors.

…

Wages are the secret sauce of regional affordability. Average wages paid to Florida workers lag the other markets, taking four of the bottom five spots annually in the RCR.

“Average wages provide an indication of the type of jobs in a market, and the buying power of a region,” reads the RCR.

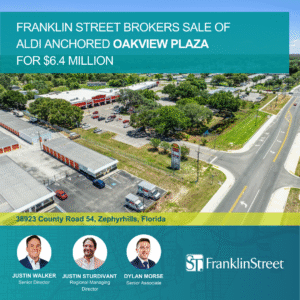

On a relative basis, people don’t make enough money in Florida, said Franklin Street CEO Andrew Wright. He provides an annual assessment of growth and real estate trends at the Tampa Bay Business Journal’s annual Economic Outlook.

“The state’s median income is extremely low and has been for a long period of time,” Wright said.

However, there is a reason for some optimism. The region is well-positioned to weather pandemic friction, and that bodes well, Wright said.

“Our economies have been growing so fast, well in excess of a combination of inflation and population growth, and you are starting to see that lift of household median income,” he said. “But there’s so much population growth on relative affordability. Tampa Bay is definitely not affordable as we sit here today.”

…

Rising costs and stagnant wages are taking a toll on workers Tampa Bay companies need to operate and evolve.

“There are more ALICE (Asset limited, income constrained, employed households) households than households in poverty, and the number of ALICE households is increasing at a faster rate,” its 2020 report said. Other metrics often underestimate the number of households that “cannot afford to live and work in the modern economy.”

In 2007, 22% of Florida households were ALICE households. In 2018, that grew to 33% — and the pandemic has added further stress. Those at the Federal Poverty level fluctuated at around 13% throughout the period, its 2020 report said.

“Inflation doesn’t hurt someone like me,” Franklin Street’s Wright said. “I own a building. I charge more for rent on the same basis. I’m going to make a lot more money in inflation.”

But for people on fixed incomes, when food, gas, transportation and health care cost more, costs are far outpacing median income, Wright said.

“For existing Floridians, it hasn’t been cheap and it’s going to get a lot worse,” he said.