This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Insurance Services

Commercial Real Estate Experts

Shrinking Liability Insurance Marketplace

Increased Jury Awards and Settlements

Tenant Discrimination Lawsuits

Record Hail Events Across the Country

Hardening Commercial Property Insurance Market

Protracted Claims Settlements

Difficult Lender Requirements

Inaccurate Insurance Cost Indications on Acquisitions

1

+

insurance carrier partners

1

+

Multifamily units

1

+

Commercial SQFT

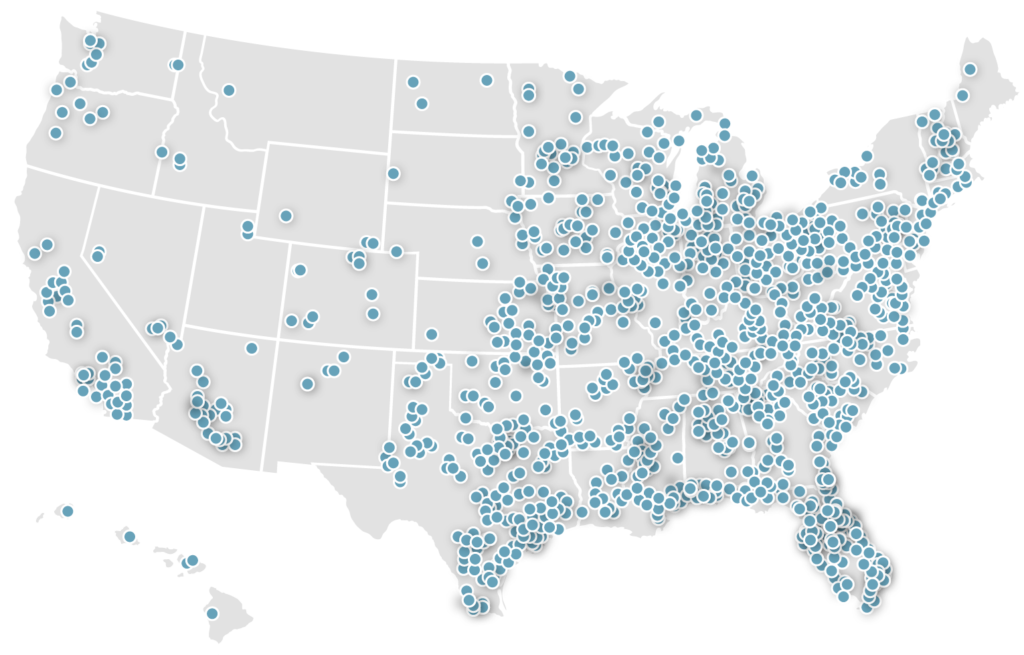

Providing Insurance Solutions For Clients Across the Country

Franklin Street has the capabilities and expertise to handle complex real estate portfolios throughout the United States

- Commercial Real Estate

- Subsidized and affordable

- Conventional housing

- Student housing

- Retail

- Office

- Industrial

- Hospitality

- Owners

- Managers

- Developers

- Investors

Full-service brokerage specializing in insurance & risk management

Affordable Housing

12,758 Units

AL, FL, GA, LA, MD, NC, TN, UT, VA, WA

Market Rate

11,530 Units

CT, FL, GA, NJ, NY, TX, VA

Affordable Housing

10,051 Units

CA, DC, GA, HI, IL, MD, NC, NY, PA, RI, UT, VA

Market Rate

9,892 Units

CA, DC, GA, HI, IL, MD, NC, NY, PA, RI, UT, VA

Affordable Housing

9,752 Units

CA, FL, GA, MA, MI, NJ, NV, NY, TX, WA

Retail | Office

1,391,234 SQFT

FL, MA, NY

Market Rate

9,749 Units

CT, FL, GA, NJ, NY, TX, VA

Affordable Housing

5,947 Units

TX, MO, KS

Retail | Office

600,000 SQFT

TX, OK

Market Rate

8,711 Units

AR, GA, KY, LA, NY, OH, TN

Market Rate

6,466 Units

AZ, GA, IN, NC, TN

Retail | Office

3,815,000 SQFT

TX, MD, OH

Retail | Office

5,226,438 SQFT

AZ, CA, CO, GA, IL, IN, LA, MI, MS, NE, NV, OH, PA, VA

Market Rate

8,720 Units

FL, GA, MD, NC, PA, SC, VA

Previous slide

Next slide

We help investors, developers, and property managers by:

- Identifying, analyzing and reducing Property & Casualty Risks

- Smoothly closing on acquisitions from early cost indications to close

- Negotiating and ensuring compliance for all lender insurance requirements

- Designing the most cost-effective insurance program based on client’s needs and risk appetite

- Claims advocacy to ensure the most favorable outcomes

- Protecting family assets

Tailored Strategies

Franklin Street utilizes business intelligence software to conduct an in-depth analysis of our client’s portfolios. This report identifies trends to:

- Make data-driven decisions for portfolio placements in the market

- Identify inefficiencies in current program structures

- Analyze exposure and claim data

- Track the frequency and severity of losses by location

- Understand losses to implement risk management strategies

Our Services

Program

Design

Our insurance marketing process, from submission to binding, ensures our clients receive the most cost-effective program with the best coverages.

learn more

Acquisitions & Lender Compliance

Manages the acquisition process from pre-contract to close including lender communication. We provide premium estimates for any potential acquisitions for use in the client's underwriting.

learn more

Claims & Risk Management

Supported by our dynamic team of professionals, our client's claims will be handled timely and effectively to achieve optimum results that will positively impact their portfolios.

learn more

Program Administration

The day-to-day servicing of our clients’ accounts with regard to certificates, invoices, endorsements, inspections, and billings is our responsibility to your program.

learn more

Data

Analytics

Franklin Street uses cutting-edge software and technology to gain valuable insights to implement risk management strategies.

learn more

"I have had the pleasure of working with several Associates of Franklin Street Insurance Services, during Fannie Mae/Freddie Mac loan process for their clients. They consistently offer both Insureds and Lenders superb customer service and professionalism, while displaying a vast knowledge and under-standing of the lending products. Outstanding ethics and expertise seem to be the standard, not exception, for all Associates. Franklin Street should be the example of what to expect on an insurance level, industry wide."

Insurance Consultant, Walker Dunlop

“My colleagues and I work with insurance brokers all across the country, and we have been extremely impressed with the response time, positive demeanor and overall professionalism of the Franklin Street Team. Taylor Blanton and E’lise Rainey are a testament to their insureds in responding quickly and efficiently so that their client’s insurance is in place for time sensitive closings.”

Senior Analyst, Harbor Group Consulting

“Franklin Street’s agents provide a level of professionalism, efficiency, and responsiveness that is exceptional. Their thorough understanding of the complex needs of their clients in conjunction with the requirements of various lenders and investors ensures a smooth transaction each and every time.”

Senior Insurance Analyst, JLL

"These guys are life savers. They did all four of our last deals and they were done before I needed them to be.”

Vice President, NorthMarq Capital

“Thanks for being very accommodating and super responsive. You’ve been such a pleasure to work with!”

Director, Harbor Group Consulting

“You and your team are really the best agent/agency I have ever had the pleasure of working with. Thank you for all your help on these four loans – I know if there was a different agency assigned, this review would not have gone as smoothly.”

Arbor Realty Trust

Previous

Next

Multifamily Insurance Market Update

We Handle All Commercial Real Estate

Insurance Office Locations

TAMPA

- 813.839.7300

1311 N Westshore Blvd

Suite 200

Tampa, FL 33607

Ft. Lauderdale

- 954.640.1100

1000 S Pine Island Road

Suite 901

Plantation, FL 33324

Chicago

- 312.598.2665

875 N Michigan Ave

Suite 3718

Chicago, IL 60611

Insurance In The News

November 14, 2023

insights & expertise

Connect With Us

Get in Touch

Ready to Purchase Your Next Investment Property?

Peace of mind & premium coverage for your investments

Count on a safe & reliable environment for your property

Are you ready to take the next step in your career?