Florida might have dodged a bullet from Hurricane Ida, but consumers in the Sunshine State ultimately won’t be able to escape its financial wrath.

Insurance experts say Ida will drive up rates for reinsurance — which is insurance that insurance companies must buy to guarantee they can pay all claims after a disaster — and those insurance companies will pass those higher rates down to us.

Everyone is likely to feel the effects: Homeowners will see their insurance bills rise. Landlords will pass the increases down to tenants. Retail stores will pass them down to customers. Restaurants will charge more for meals.

…

But Ida is likely to drive up rates for insurance purchased for large commercial properties, including apartment complexes and condominium structures. Many of those policies are written in the so-called surplus lines market, dominated by companies like Lloyds of London, because the insured structures are large and expensive with risks that are difficult to measure.

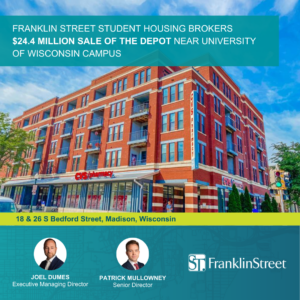

Evan Seacat, regional managing director for the real estate and insurance service firm Franklin Street, says his many of firm’s clients, who collectively own 30,000 to 35,000 multifamily units in South Florida, are nervous about Ida’s potential to increase their insurance costs further, following two to three years of large rate increases.

And while his company’s bargaining power can help lessen the blow for its clients, ultimately, he said, Ida “will affect us here in South Florida for the next two or three years.”