Sports Authority, Circuit City and Linens N Things are long gone. Macy’s, JCPenney and Sears are shrinking.

And, counter-intuitively, it’s a profitable time to be a retail landlord in Palm Beach County.

Despite a drumbeat of dreary headlines from the retail sector, the vacancy rate for Palm Beach County shopping space fell to 4.4 percent at the end of 2016, according to commercial real estate brokerage Colliers International. That’s the lowest level since 2007, when the county’s economy was at the height of a housing-fueled frenzy.

New leases outpaced move-outs by more than 1 million square feet in 2016, the best pace of absorption since 2006. And rental rates are rising.

“It’s not as much doom and gloom as people think,” said Katy Welsh, senior vice president at Colliers International’s Boca Raton office.

Sports Authority’s demise last year threatened to blow a hole in the local retail market. After all, the merchant leased a total off 250,000 square feet in Palm Beach County.

Instead, Sports Authority’s failure gave the county’s retail sector a chance to flex its muscles. A 43,000-square-foot store at 3350 Northlake Blvd. in Palm Beach Gardens already has been filled by Rooms to Go Outlet.

And Sports Authority’s 43,000-square-foot location at 20851 South State Road 7 west of Boca Raton has been taken by Burlington Coat Factory.

“A store closing is a leasing opportunity for me,” Welsh said.

And possibly a profitable opportunity. With rental rates rising, landlords can replace old tenants paying low rates with new merchants willing to pay more rent.

For instance, Sports Authority was paying $15.87 a square foot for its Palm Beach Gardens store, according to a bankruptcy filing. The average rent in that market now is $21.33, according to Colliers International.

And the failed retailer paid $20.21 a square foot for its space in west Boca, where the average rent now is $28.63.

“A lot of those leases originated 10 or 20 years ago,” said Gary Broidis, a broker at Atlantic Commercial Group in Delray Beach. “It’s been a big windfall for a lot of owners of these boxes.”

Amid all the headlines about Amazon killing brick-and-mortar merchants, it’s difficult to find an empty box in a desirable location.

The surprising resilience of the retail sector is good news for Palm Beach County’s property market, where the combined value of shopping centers climbs well into the billions of dollars, and the property tax bill reaches into the hundreds of millions.

Four of the six priciest real estate deals in county history are for retail space, led by the $341 million sale of the Mall at Wellington Green in 2014. The Town Center Mall in Boca Raton is worth $460 million, according to the Palm Beach County Property Appraiser, and paid $8.6 million in property taxes last year.

Not that every center in the county is booming.

The former Loehmann’s Plaza at Interstate 95 and PGA Boulevard has struggled to find tenants. The property has been the subject of a legal battle that began in January 2013 after Palm Beach Gardens rejected a BJ’s Wholesale Club.

And in Lantana, landlord Equity One sold the Kmart-anchored Lantana Village center in January for a rock-bottom price. The 166,771-square-foot property fetched $10.2 million, or just $61 a square foot.

Equity One said the average rent at the property was just $7.84 a square foot, second-lowest among the 52 shopping centers the landlord owns in Florida.

Meanwhile, the rise of Amazon and other online shopping sites has wounded such traditional merchants as Macy’s and Office Depot.

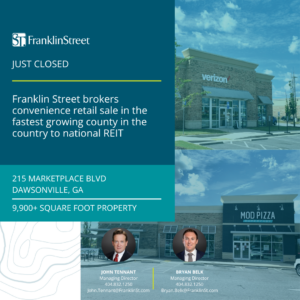

“We’re going through a transition in the real estate market,” said Robert Granda, a broker at commercial real estate firm Franklin Street. “E-commerce is changing the way consumers shop.”

Even so, this shift is a change, not a funeral dirge.

Take the former Loehmann’s store at Legacy Place in Palm Beach Gardens. Soon after that space went dark, The Container Store snapped up the 25,000-square-foot box. Kmart closed its Lake Park location, but Rooms to Go moved into the 94,000-square-foot box.

Dollar stores and auto parts stores have been expanding into smaller spaces. And grocers still see a booming market, as evidenced by the expansion of Publix, Trader Joe’s and Wal-Mart Neighborhood Market.

Reflecting the tight vacancy rates, developers are beginning to break ground on new projects. Water Tower Commons in Lantana, for instance, will add more than 300,000 square feet of space on the site of a former state hospital on Lantana Road.