Rents are rising, lenders are competing on condo deals, land’s trading at high prices, cranes are everywhere—the state of Miami multifamily is clearly robust. But for how long?

Our speakers at Bisnow’s Miami Multifamily Summit at the Hyatt Regency this week wrestled with this topic. The conclusion: it’s tricky. Demand for both rental and for-sale properties is strong, fueled by Millennials and eager condo investors with cash. Also, any downturn this time is likely to be a slowdown rather than a crash, because of the more conservative way deals are structured. (People may still be wearing barrels, but only because it’s become fashionable.)

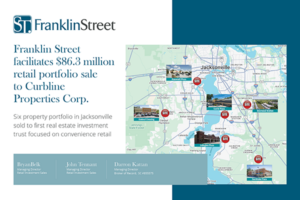

Franklin Street regional managing partner Deme Mekras and Grass River Property principal Chris Cobb. One thing that’s different about this expansion, our speakers noted, is that Miami is experiencing what it’s like to be a big city on an international scale: an influx of people and capital from around the world, infrastructure growth, world-caliber arts and dining, and more. Both domestic and overseas investors consider Miami in that light, yet they still see land and other investment opportunities here as a bargain compared with the likes of New York and Hong Kong.