Many of you have read about, and experienced, the current multifamily investment frenzy as we continue to learn of new Class A developments on almost a daily basis.

Clearly, the market for apartments has been on a very strong run, driven by the low cost of debt and the abundance of equity that prefers this product type. Most of the focus has been on well-located stabilized and value-add product in urban and suburban markets, with less attention on Class C product in the same locales.

As Class C becomes more popular, however,t hose searching for well-located C product might be in for a little sticker shock: The market has caught up faster than most might have expected. Factors such as rising rents, continued redevelopment, and seller sentiment are continuing to push pricing in this space. Thus, investors seeking high yield might still need to look in tertiary markets or take on higher-risk value-add assets.

Hitting a High “C”

While values today are strong for well-located product regardless of age, rising rental rates are supporting the higher C pricing.

In Atlanta, a lot of infill multifamily product was built between the 1920s and the early 1970s. By the late ’70s and ’80s, the focus had shifted to suburban development. As demand today continues to move back to urban living, this older, pre-1970s product is experiencing strong demand despite the introduction of new product.

This older product is witnessing almost comparable rents, on a per-square-foot basis, to those at newer developments because of unit sizes and layouts. While an older apartment at $1.50 per square foot might seem high, the tenant who can live in Midtown for $825 per month doesn’t analyze his rent per square foot.

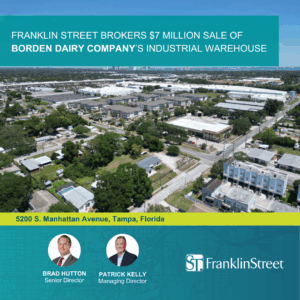

Rental rates are pushing values, as well. Franklin Street recently sold an infill apartment complex that’s more than 70 years old and made up of mostly one-bedroom units, for $90,000 per unit, and listed another at more than $110,000 per unit.

Buyers are recognizing that there’s still a lot of potential for increased rents at well-located Class C product. Given that the ownership of this product class consists mostly of private investors, many have made no improvements to their proerties, and some are reluctant to increase the rents as self-managers. The owners that have raised rents, however, have been pleasantly surprised – this despite very few of them having truly tested the market by making upgrades to kitchens and baths.

ACQ – Rehab Also in the Mix

Another factor affecting Class apartment values is redevelopment. Apartment, townhouse, and even condo developers have been targeting well-located aging apartment communities. Multifamily sites with zoning that allows for higher density give developers a head start on delivering new product. This demand for land might continue to increase; however, the values of this product are continuing to rise because of improving fundamentals. In fact, we are already witnessing a diminishing premium associated with land as it relates to existing value because of these improving fundamentals.

The most recent dynamic affecting values, however, isn’t land or redevelopment but, rather, the lack of existing inventory. While it hasn’t been that long since many owners saw their values diminished by the Great Recession, many are reluctant to sell because of higher capital-gains rates and a concern over the ability to find a viable 1031 exchange as a means of deferring capital-gains taxes.

Jake Reid is senior director of Franklin Street Real Estate Services, focusing on multifamily sales for the firm’s Atlanta office.

View PDF