More mergers and acquisitions may increase in the commercial real estate industry next year as these types of deals in general may see a spike.

Rumors are swirling about these potential deals in the commercial real estate sector, which makes sense because the cost of capital is low and stress is high, said Paul Ellis CEO of Orlando-based Foundry Commercial LLC. Those are the ingredients that typically are present before more mergers and acquisitions.

…

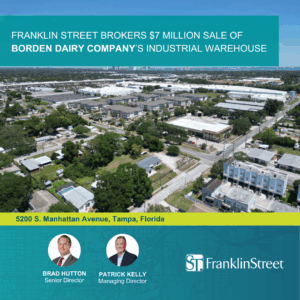

Meanwhile, commercial real estate firms will face other changes too. For example, more commercial real estate firms will likely realize how important it is to have diversity in their platforms — especially as the pandemic has hurt the office, retail and hospitality sectors, said Kurt Keaton, managing line president at Tampa-based Franklin Street. Diversification helps keep brokers and other workers occupied when one sector slows.

“That’s worked well [at Franklin Street] and helps build a collaborative culture,” Keaton said.