ATLANTA — During the past five years, the retail world has seen tenant activity diminish and shopping center vacancy rise. Landlords have been forced to find creative ways to maintain net operating income (NOI) and reduce the surplus of retail vacancy.

This trend has created a noticeable paradigm shift in retail leasing — specifically as it pertains to office and medical tenants — such as urgent care facilities, dentist clinics, chiropractors and call centers. Tenants who traditionally occupied space in office or medical complexes are finding that by positioning themselves within retail centers, they garner an increased exposure to consumers while reducing overhead cost.

DaVita Dialysis, part of DaVita HealthCare Partners Inc., has opened several 4,000- to 6,000-squarefoot clinics in shopping centers across the Atlanta area, including the backfill of a second-generation Blockbuster space positioned in front of an Inland Real Estate Group-owned Publix center at 4422 Hugh Howell Road in Tucker, Ga. The company has taken space in many shopping centers throughout the nation as one of

two publicly traded dialysis companies in the U.S.

Orthodontic practices are also becoming more frequent in shopping centers across the country. OrthoSynetics, a dental practice management firm, operates a 1,600-square-foot location at a Walmart-anchored shopping center in Warner Robbins, Ga. The company currently has 350 locations across the U.S. with plans for continued growth.

Urgent Care facilities have also become popular nontraditional tenants including the 2,000-square-foot Alpha Medical Clinic, located in the Kimco-owned Market at Haynes Bridge at 3000 Old Alabama Road in Alpharetta, Ga. This is the first location Alpha Medical has opened, choosing Georgia to launch its business. Urgent care centers provide convenience for consumers by filling in a gap in healthcare for quick-service cases — including acute ear infections, high fever, broken bones and other non-emergency circumstances.

Nontraditional shopping center squeeze

Many regional and national tenants are capitalizing on the occupancy levels within a shopping center through the benefit of cotenancy clauses or other restriction agreements with the landlord. These agreements often reveal that only a certain

percentage of shopping centers can be leased to nonretail tenants. This is because nontraditional retailers frequently are a second- or third-tier backfill of space and don’t always generate a large amount of steady foot traffic.

The dichotomy between traditional and nontraditional retailers has forced landlords to find inventive ways to negotiate terms, which enables them to reduce the surplus of vacancy and maintain the presence of retail tenants. In many cases, this means

allowing existing tenants to pay rent based on a percentage of gross sales.

Usually, these regional and national anchors tend to restrict nonretail tenants in power centers. However, landlords are finding ways to negotiate those terms instead of settling for tenants on short-term leases. This is due to the increasing demand of

landlords to place office tenants in shopping center spaces to drive up NOI while also managing the surplus of vacancy.

Creating nontraditional tenant awareness

While this influx of nontraditional retailers may diminish the synergy desired by some tenants, having nontraditional tenants can be beneficial to other tenants by bringing potential customers closer to stores. This advantage also can provide a convenience

to customers. For instance, a patient can pick up a prescription from a pharmacy located in the same center as a medical office tenant, or the family member of a patient from one of these facilities can shop while the patient is visiting the facility. Landlords

have seen this mutual benefit to having nontraditional tenants in their centers.

Most landlords welcome the potential of a good credit tenant and a stabilized NOI. However, landlords are still cautious when choosing nontraditional tenants as they may deter the traffic of traditional retail co-tenants.

“Over the past few years, we have certainly seen an uptick in activity from nonretail tenants such as medical users in groceryanchored shopping centers,” says Andy McHargue, leasing specialist for Butler, Pa.-based Armstrong Development. “While

some national and regional retailers try to restrict the number of nonretail co-tenants, we as landlords, are concerned with striking a balance with our anchor tenants as well as stabilizing the NOI. As such, we are attracted to the credit and financial strength that come with tenants such as doctors, dentists and orthodontists.”

In the next year, continued vacancy, slow absorption rates and the need for landlords to drive up NOI will continue at shopping centers. This will create favorable conditions for nontraditional tenants. With the good credit reputation of the office medical

tenant, it will continually become more difficult for national tenants to negotiate co-tenancy clauses or other restriction agreements with landlords.

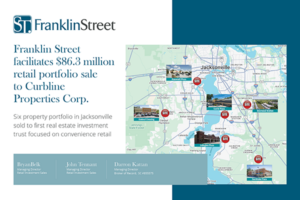

— John Tennant is the senior director for Franklin Street Real Estate, specializing in landlord representation in the Southeastern/Georgia markets.