Excerpted from CoStar story.

Aaron’s Inc., the Atlanta-based rent-to-own retailer, reported record revenue in the first quarter, topping $1 billion for the first time.

The company said it had higher same-store revenue and growth in its subsidiary Progressive Leasing, which offers web-based, lease-to-own to-own financing for its stores and other retailers. The company also boosted revenue by buying four more franchised stores, adding to the 152 it acquired last year.

But the retailer also closed 85 company-operated stores, drawing down the number of those stores to 1,230, leaving landlords with space to fill. With the purchase of franchise locations, the number of franchises drops to 369.

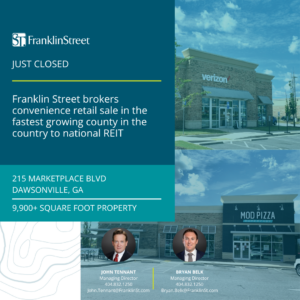

Rather than expand and build new stores, Aaron’s has been pursuing a strategy of closing underperforming locations and consolidating business into existing, better-performing and larger stores. Bryan Belk, senior director for retail real estate investment sales with Franklin Street in Atlanta, said Aaron’s hasn’t “added anything new in a while.”

According to retail brokers, Aaron’s locations are evenly split between multi-tenant retail centers and standalone locations. The standalone locations, in particular, are bought and sold as net lease properties in which the tenant covers most of the operating expense on the properties.

Belk said bringing in a new tenant could be a challenge for the closed locations because they tend to be in so-called secondary areas with lower income demographics. There aren’t many national retail options for such places beyond dollar stores, he said.

For full story, visit https://product.costar.com/home/news/1590894347?