Investor appetites shifted in 2015 and are likely to continue changing next year. Where should capital focus next?

Strong. That’s the word many industry analysts are using to describe capital flows into commercial real estate through the fourth quarter of 2016. But, of course, there are various factors that could weaken that strength, from high prices and valuations to rising interest rates and economic uncertainties.

Still, strong is the trending keyword. According to the Urban Land Institute Center for Captial Market and Real Estate, the commercial real estate market is on pace to experience favorable conditions through 2017. Specifically, commercial real estate prices are projected to rise by 10% in 2015 before slowing to a 6% increase in 2016 and finally dipping to a 4.5% rise in 2017. Vacancy rates are expected to continue declining and rents to continue rising.

“Although common sense would dictate a slowdown in 2016, I do not see a meaningful slowdown, since equity raises are at an all-time high,” says Brian Sykes, senior vice president of loan originations at Capital One. “Investors who are tired of anemic savings and bond rates and are less than enthused by the stock market volatility are clamoring for the attractive yields being offered by real estate funds.”

How Appetites Have Shifted

All that said, it’s clear that investor appetites have shifted and may continue shifting in 2016. From the big picture view, the market has seen a gradual shift from prime class A properties only to a willingness to explore and invest in secondary and even tertiary markets, as well as class B assets. That’s ultimately because investors are looking for better returns.

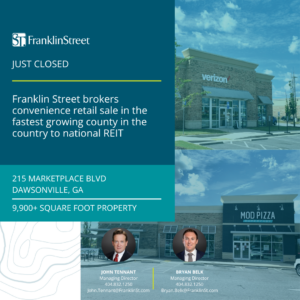

“In the Southeast, we continuously heard from institutional investors that they were only interested in Atlanta, Raleigh, Charlotte and prime Florida markets,” says Bryan Belk, senior director in Franklin Street‘s Atlanta office. “Now that returns in those markets have compressed, we are seeing more large investors willing to stretch out to markets such as Nashville, Huntsville or Jacksonville to get returns they promised to their investors because competition and lack of supply in primary markets is so great.”

Steve Grimes, CEO of Oak Brook, IL-based Retail Properties of America, a self managed REIT focused on the acquisition, development and management of strategically located real estate assets and one of the largest owners and operators of shopping centers in the US, sees investors shifting from new acquisition returns to properties with long-term development or redevelopment/densification opportunities, especially in urban areas.

“From a return-on-cost perspective, development and redevelopment returns are strong in contrast to new-acquisition returns,” Grimes says, “and with the continued lack of new supply, especially in the class A retail centers, redevelopment opportunities and secondary markets have been driving better returns-on-investment as demand continues to outweigh supply.”

The office sector has seen a definite shift in the past year, according to Martin Caverly, chief investment officer at Los Angeles-based Resource Real Estate, a national real estate firm specializing in opportunistic and value-added investing in and financing of commercial real estate. He is starting to see a commercial office space migrate out of the big five gateway markets – Los Angeles, San Francisco, Washington DC, New York, Boston – into surrounding areas, such as Brooklyn, West Side L.A., Downtown L.A. or Orange County.

“Like most asset classes today, it’s a search for yield. In every cycle, core central business districts in most markets recover first and then demand moves out to secondary markets,” Caverly says. “Two years ago, investors wouldn’t touch Phoenix. Now, it’s gaining traction. Unfortunately, people forget that secondary markets trade at higher yields to make up for the fact that they are more volatile, so your changes of losing occupancy in a downturn are much greater.”

Clear Challenges Ahead

Nobody has a Pollyanna attitude about commercial real estate investing in 2016. Clearly, challenges lie ahead. Kurt Westfield, managing director of WC Cos., a group of real estate, investment, property management and financing companies based in Tampa, FL, expects the biggest challenges to be finding quality inventory and competing with liquid and institutional investors.

“On the heels of Blackstone, there are still a number of smaller, albeit capital-heavy, institutional players absorbing units,” Westfield says. “Additionally, with interest rates still low, more investors are able to secure mortgage instruments with low debt thresholds. I don’t foresee any major barriers to entry or new challenges in 2016 that haven’t been witnessed or overcome in 2015.”

Rising interest rates are an ongoing concern and a frequent topic of discussion. That said, investors have been listening to failed predictions of rising interest rates for the past five years. Interest rates are bound to rise at some point, though, and Sykes says that would reduce available leverage and investor returns, adding volatility to the already razor-thin prices groups are paying for multifamily assets.

One thing is certain: REITs in particular can no longer rely on record-low interest rates to push cap rate compression and value bumps. The focus, says Grimes, needs to be on improving organic growth to drive NAV. But there are still other concerns, like finding good deals, even valueadded deals. These are fewer and farther between in a mostly recovered market.

“The biggest challenge for investors in 2016 will be finding a suitable product that meets yield and return expectations without taking too much risk,” says Caverly. “Supply is certainly going to start becoming an underwriting issue in some markets as well. Rate uncertainty may create some short-term wobbles, but, over the longer term, historically higher rates have been good for real estate.”

What to Bet and Bank on

With all of these factors in mind, what are the safest bets? What can investors truly bank on? What sectors should be approached with caution or avoided altogether in certain markets? Franklin Street’s Belk recommends taking a “back to basics” approach that entails buying well-located real estate that can survive tenant turnover.

“For desired locations we are seeing continued rent escalations that landlords are getting in the 20% to 30% range,” says Belk. “A lot of those locations signed five-year leases back when the market was softer and landlords have continued to be able to successfully raise rents, as those leases have rolled for renewal because there is more tenant competition for spaces in this market.”

Grimes stresses that retail has been considered ripe for capital investment. That’s because investors, from a yield perspective, are having a tougher time finding what they are seeking in other sectors like office, industrial and multifamily. “With retail recovering, the time is ripe for investors to reap extremely compelling returns on retail properties,” he says. “However, specifically in the retail space the push is definitely still focused on an investment in mixed-use/lifestyle developments.”

From Sykes’ perspective, the best bets in 2016 are the ones from which everyone else is shying away. He says that locating well-priced deals in secondary markets and buying them with more conservative leverage—70% versus 80%, for example— could make a good strategy for private real estate owners.

Caverly has a more specific take. He’s betting on creative office space. He sees an evolutionary change occurring in how people use office space, and predicts investors who can identify it and invest in it early will enjoy higher risk-adjusted returns. Multifamily is still a darling.

“I am still bullish on multifamily through 2016,” says Westfield. “The rental market remains a driving force. Millennials have yet to exceed average figures for home ownership and continue to rent at high volume. Interest rates remain low. Capitalization rates remain above average. Economics of scaling remain beneficial and cash flow remains positive. This continues to be the top sector through 2016 through my glance.”

Proceed with (Some) Caution

Although fundamentals seem to be solid across the board, some industry watchers do take pause in some sectors. Westfield is particularly concerned about the hotel sector—and so is Joel Ross, a member of the Urban Land Institute who began his career as an investment banker on Wall Street in 1965.

“It’s not that hotels are bad as investments,” Ross says. “Many people have bought hotels over the past five years and made good returns because they bought distressed deals and did the needed renovation to be able to resell this year at high returns. There are still very good hotel deals around where there is poor management, failure to renovate, and deep value add. I am doing one myself so I am not saying no hotels.”

Ross’ point: don’t drink the Kool-Aid. He cautions not to just accept the nationwide averages of RevPAR as being at all meaningful to investors. His advice: Dig into the individual deal and submarket, look for deep value add and a very good manager, and most of all do your own due diligence and your own projections.

“If you just buy an ordinary branded hotel now and think you will make good returns because the hotel industry puts out things like false value improvements and says things like it being ‘the golden age,’ you will get disappointing returns,” Ross says. “The brands in search of ways to keep revenue flowing to maintain stock prices are coming out with a flood of new brands and then ignoring impact areas for existing franchisees, which harms their ability to raise rates. This is a huge issue now.”

Westfield is concerned about overbuilding in some of the 24/7 cities and Belk shares similar concerns, especially on the multifamily front. With the amount of new development, Belk thinks the market is teetering on oversupply of higher-end apartment living. “They’re being marketed as targeting Millennials,” he says, “but I don’t see how your average recent college graduate can afford $1,500 to $1,800 a month in rent when wages have not increased substantially for recent college graduates.”

Marketing the X Factors

X factors may be unknown, but not completely. Industry watchers are keeping a close eye on various issues, beyond interest rates and global economic volatility that could impact commercial real estate markets.

Caverly, for example, is watching for tax law changes that could hit the commercial real estate market, such as eliminating mortgage tax write-offs or 1031 exchanges and keeping or increasing restrictions on treatment for foreign investors. Many feel that tax law changes in 1986 worsened the real estate decline that ran from 1989 to 1992.

“Over-leveraging debt continues to be a hot button for me,” Westfield warns. “Too often we see investors seeking copious amounts of debt in growing their portfolios. There is no denying an ability to leverage smart debt. However, cash remains to be king and assets owned free and clear still provide the most upside with the least amount of risk.”

As for Grimes, he’s looking at the big retail picture. For consumers and retailers, technological innovation will continue to drive changes in the retail experience and in the ways that consumers shop, which impacts a center’s success. “Today most analysts are moving away from the idea that the Internet will obliterate bricks-and mortar retail and are focused on it adding a new and exciting dimension to the buying experience,” he says, “but centers must keep up and adapt or they will be considered irrelevant moving forward.”

Then there are the X factors on the development front. Belk says he continuously hears concerns from developers about the potential delivery dates of their projects. “Time and again they have expressed they would like to have their projects finished before 2017,” he says, “because they do not know what the market will be like when all the 10-year debt from 2007 rolls over.”

Looking Ahead

With all the challenges, X factors, data points and opportunities, what will 2016 see on the investment front? It goes back to the first word in our story: strong, at least through 2017.

“Major economic drivers have maintained a strong presence from leveraged and financed investors and cash sales still make up an above-average chunk of the investment-class assets being purchased,” Westfield says. “Property values have risen, dramatically in our local market, amongst most major metro regions nationwide and rental rates continue to rise, promoting strong investment opportunities across the board in the multifamily sector.”

Belk echoes the sentiment of most industry watchers. From a 20,000-foot view, he is betting 2016 will be very similar to 2015. He predicts the market will see a slight increase in interest rates in 2016, but because of lack of supply and the great demand for commercial real estate he doesn’t anticipate an immediate dip in prices. Caverly is taking a little bolder approach. He predicts more commercial real estate investing in 2016 compared to 2015, on account of the tremendous search for yield across all investment asset classes.

“Real estate happens to be one of the few areas where you can construct a fairly attractive portfolio yield relative to the risk-free rate yet take less perceived risk than in other assets—like stocks and high yield bonds,” Caverly says. “Though some gateway markets have seen asset pricing exceed prior peaks, the spread one can achieve in yields versus financing costs is still at historic highs. With banks just starting to lend due to regulatory issues and plenty of capital liquidity, 2016 should be robust for commercial real estate, in spite of rising rates.”